child tax credit portal pending eligibility

Prepare your tax return for the year 2020. The Child Tax Credit Update Portal is no longer available.

Irs Investigating Why Some Families Didn T Receive September Child Tax Credit

In January 2022 the IRS will send you Letter 6419 to provide the total amount of advance Child Tax Credit payments that were disbursed to you during 2021.

. Got payment in August and September for 300 instead of 250 - I just assumed they were adding 50 every payment to make up for the missed initial. If you are eligible for the Child Tax Credit but did not receive advance Child Tax Credit payments you can claim the full credit amount when you file your 2021 tax return during. What can I do now to ensure that I receive Child Tax Credit payments in advance in 2021.

The credit is part of a series of advance payments from the IRS to families eligible for the federal governments child tax scheme which began on Jul. You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021. Youre not required to file an amended return to receive advance Child Tax Credit payments.

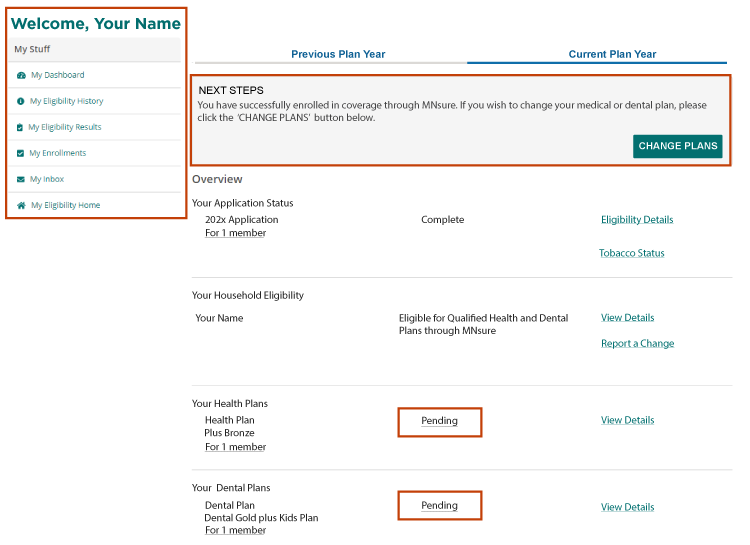

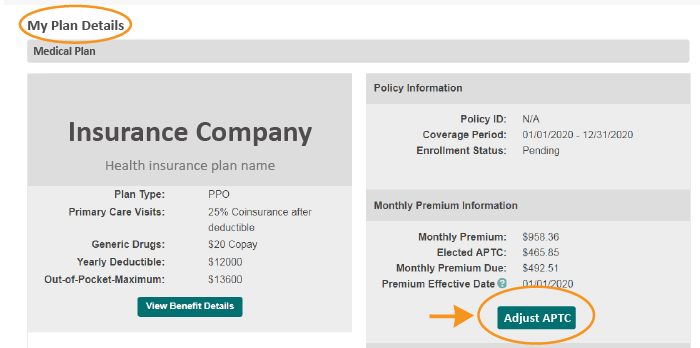

If the Child Tax Credit Update Portal returns a pending eligibility status it means the IRS is still trying to determine whether you qualify. Amended and missed my first payment. As provided in this Topic E if the IRS has not processed your 2020 tax return as of the payment.

Your eligibility is pending. Child Tax Credits September Payments Go Out Soon What To Do If You Don T Get One To be eligible for the full. My 2020 return was processed but then went under review.

Im listed as pending. You will not receive advance. So i dont know if thats considered not processed or not but regardless they should be able to see.

You may receive the advance Child Tax Credit. Payment Issues with the Monthly Child Tax. Does anyone elses child tax credit portal say pending eligibility.

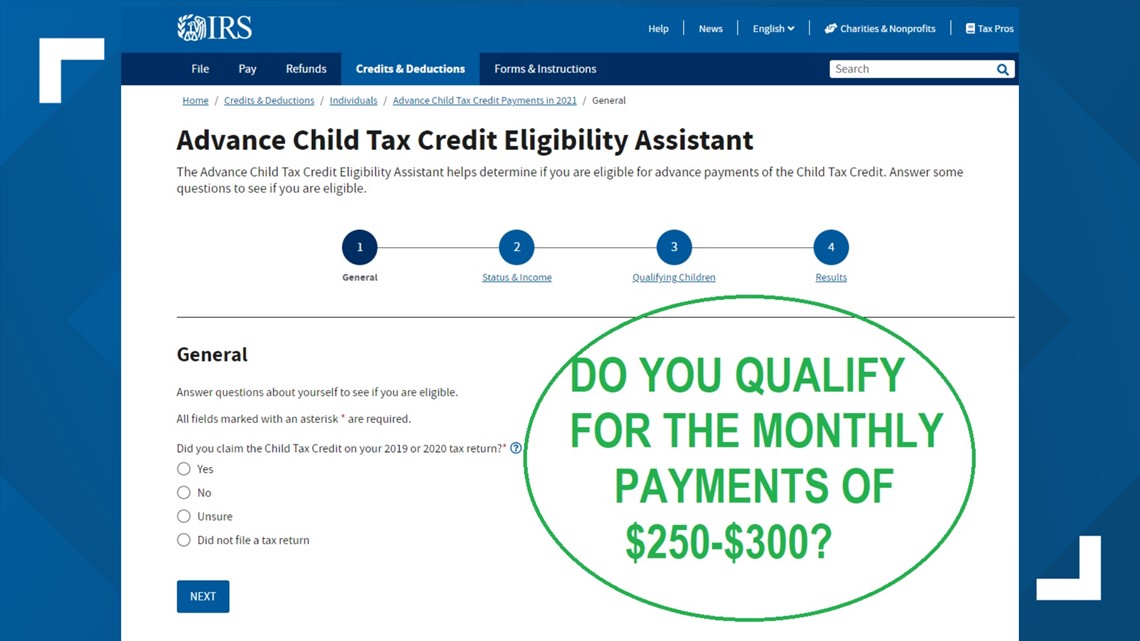

If the portal indicates your payment is pending eligibility the IRS is reviewing your account to determine if you are eligible. If on the IRS website in Eligibility Status of your Child Tax Credit it says Pending your eligibility has not been determined.

Turbotax Reminder For Parents The Irs Will Begin Distributing The First Monthly Child Tax Credit Advance Payment To Qualifying Families Today If You Re Eligible You May Start Receiving Up To 300

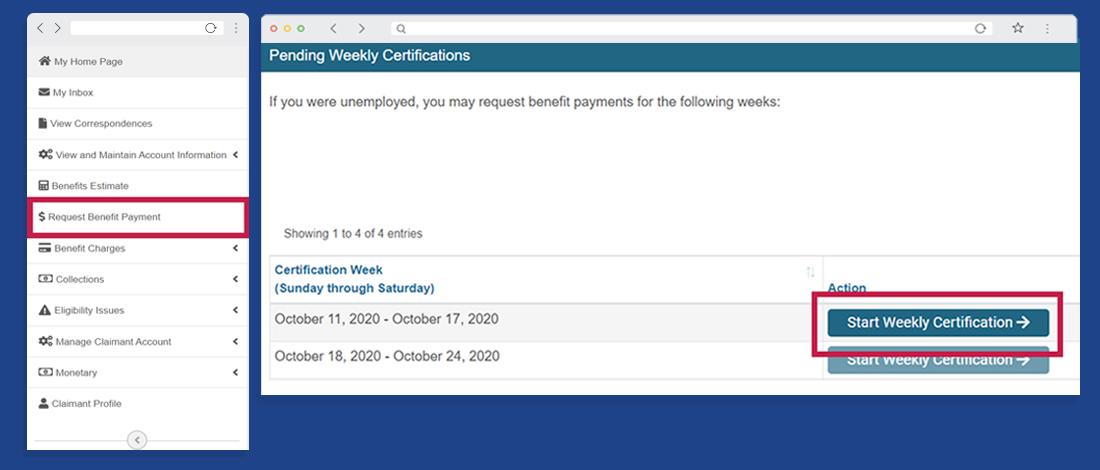

Myui Department Of Labor Employment

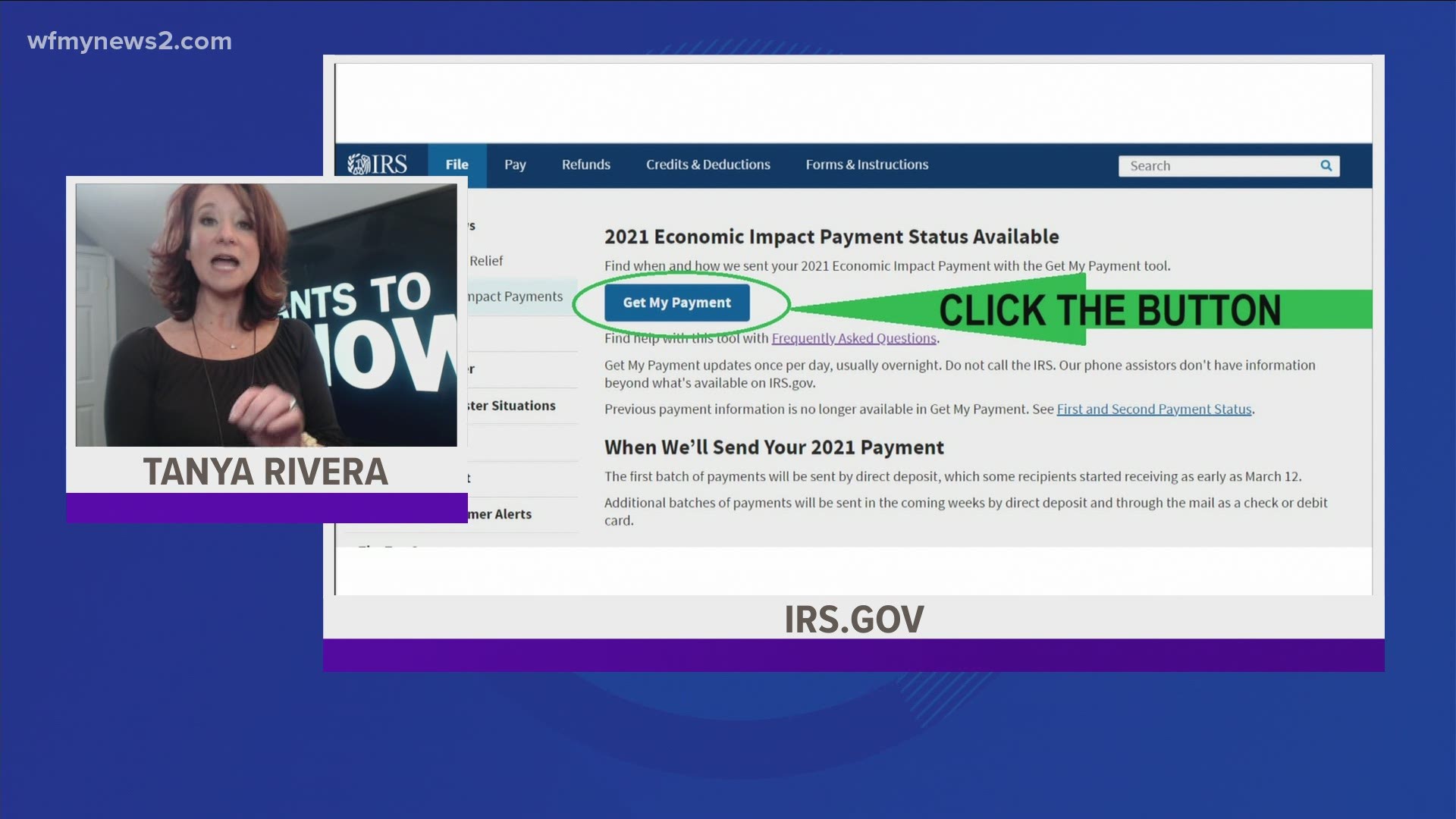

Why You Ll Have To Wait Until March 17 For Your Stimulus Money Wfmynews2 Com

I Got My Refund Ctc Portal Updated With Payments Facebook

Irsnews On Twitter Not Sure If You Qualify For Advance Childtaxcredit Payments Check Your Eligibility By Using Our Advance Child Tax Credit Eligibility Assistant Learn More From Irs At Https T Co 9j5hb58rqx Irstaxtip Https T Co Yqqpgifza6

Why Is My Eligibility Pending For Child Tax Credit Payments

Monthly Child Tax Credit Payments Have Ended And Their Future Is Unclear

Monthly Child Tax Credit Payments Have Ended And Their Future Is Unclear

What To Do If You Still Haven T Received Your Child Tax Credit Payment Forbes Advisor

Childctc The Child Tax Credit The White House

Preview Of New Wotc Dashboard Cost Management Services Work Opportunity Tax Credits Experts

Puyallup Wa Accounting Firm Child Tax Credit 2021 Page Powers Public Accounting P S Inc

Where S My Child Tax Credit Payment A Guide For Frustrated Parents The Washington Post

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Pua For Workers With Pending Or Denied Issues

Do You Qualify For The Child Tax Credit Payments Find Out Here Wfmynews2 Com